☁ Runs on the Cloud or on premises

Cover IFR/IFD and simulate impact

Everix proposes funds and investment firms a robust and easy-to-use implementation of 2019/2033 regulation with rich view of K-factors available from your browser.

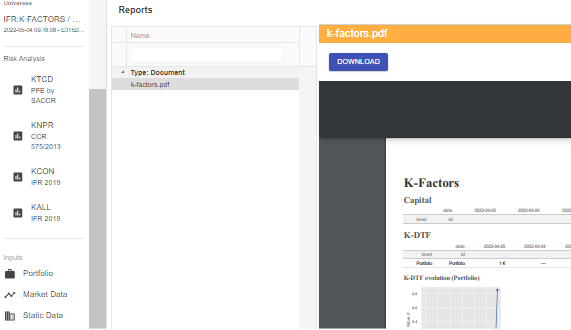

Simulate pre-trade impact on capital of any asset class right from your browser, receive daily reports and be guided on the methodological choices.

K-factors without hassle

Most investments firms and funds are subject to report K-factors

K-factors rely on different methods of data aggregation depending on methodological choices. This requires significant attention to details, requires a lot of manipulations and is prone to errors.

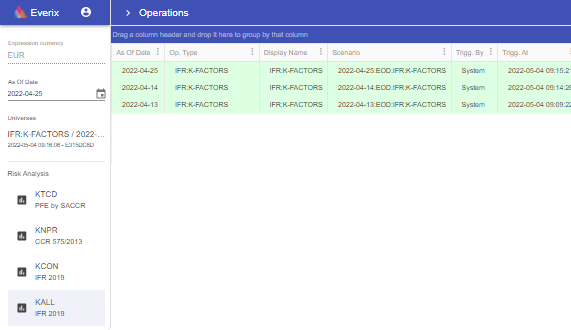

Figures computed daily and published monthly with internal and regulatory limits . All asset classes covered for listed and OTC derivatives: commodities, equities, interest rate, forex.

Guided experience

We provide full guidance: plugging Everix to your Front-Office system, choosing the most suitable methodology, tuning for your needs, adjusting regulatory reports. No thirdparty contractors, fast implementation, very affordable.

Regulatory Coverage

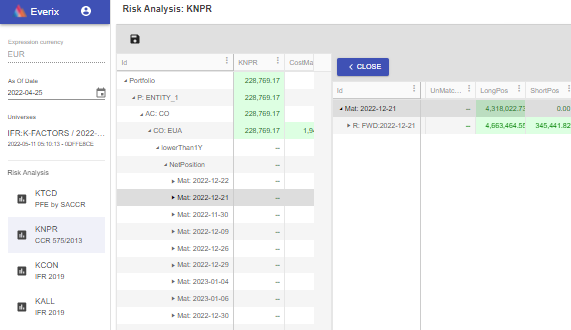

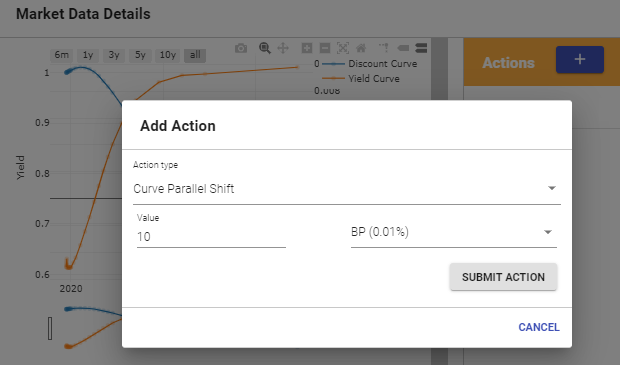

Market Risk: Risk-To-Market (RtM) factors

- Scope: listed and OTC derivatives of trading portfolio

- K-NPR for uncleared portfolios and K-CMG for clearing or margining upon approval, or both

- Automatic replication of the trades in elementary positions to properly net within bands

- Goal: Proper capture of netting and hedging effects

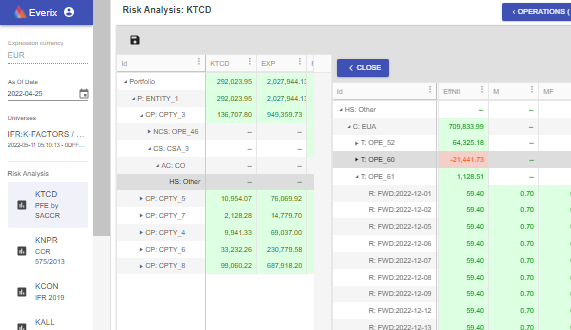

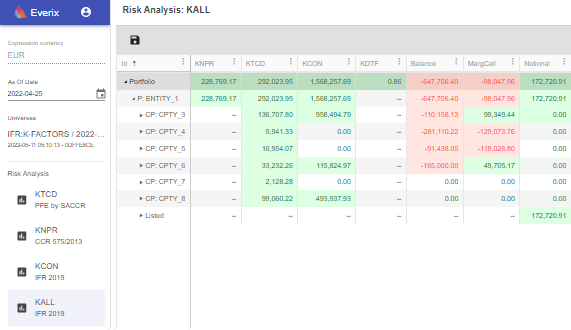

Counterparty Risk: Risk-To-Firms factors (RtF)

- Scope: derivatives portfolio for K-TCD and K-CON

- Exposure by counterparty = replacement cost RC + PFE potential future exposure

- Several options for PFE: standardized approach of CCR 575/2013, SA-CCR, or internal models with justification and approval

- Netting and hedging with risk mitigants: collateral balance, CSA attributes (MTA, IA, TH, IM etc.)

- Daily monitoring of exposure to check concentration with reporting and warnings

Consolidate Risks

Initial Margin and VaR

- Ready for Initial Margin (SIMM or schedule)

- Forecast, stress tests or extreme scenarios

- Plug your own VaR or compute it in Everix

- Fully compatible with internal model approval