Research and Innovation

Follow our research in the areas of finance, risk management, computational science and machine learning

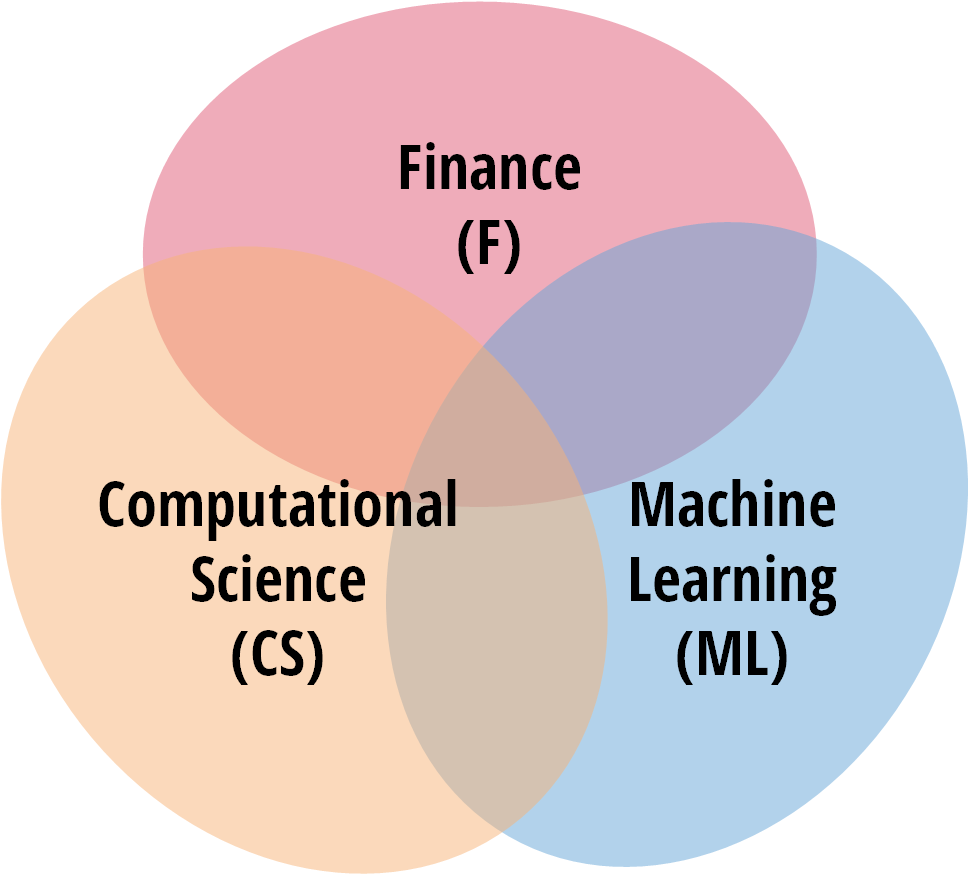

Areas of Research

- Financial science (F) is the base domain of our R&D. We target improvement of the existing methods (better convergence, validation), yet also development of the new approaches in model-based risk management.

- Computational science (CS) forms a computational basis for the platform and allows map ping complex scientific scenarios to the infrastructure. Here we touch topics of HPC, cloud computing, optimization of workflow execution, new definition languages.

- Machine learning (ML) brings new ways of managing the existing tasks in finance: pricing acceleration, automatic error detection and more.

Current Projects

Dependency Graph

Novel way to define, track dependencies between stages (bootstrap market data, price, diffuse, etc.) and optimize graphs of computation for the complex computational scenarios.

Considering dynamic dependencies we can control that only the required market data was used, optimize job and data placement on the computing grid and run only required incremental computations leveraging from what has been already computed.

Unified Language for Regulations

We see that the Silo effect is present within many large banks, when for each regulation there is one separate infrastructure and a team. We believe that this practice may be improved.

We work on the special language to describe regulations in the way that dynamic changes can be formalized and described in one place and interpreting the regulations can be done on the common infrastructure.

We have developed a distributed aggregation engine Rix which automates the full aggregation pipeline and effectively executes it on a cloud computing environment.

Accelerating Pricing with Deep Learning

Many regulations and risk analysis framework require enormous amount of pricing function invocations.

Research question: can we use deep learning models (MLP, RNN, CNN, Bayesian NN) as approximators for the fast computation of pricing or expected exposure profiles?

Fast-What-If as a way to Analyze data

Using fast approximation functions for computation of xVA enables new ways to analyse the portfolio and enriches the user experience with interactive tools.Background