On Premises or in the Cloud?

ISDA-certified SIMM™ with backtesting and what-if

ISDA-licensed SIMM™ implementation from CRIF or directly from your Front-Office system. With PNL backtesting, IM forward, what-if analysis, HVAR benchmarking and validation.

Standard Initial Margin Model (SIMM™)

Everix provides an out-of-the-box ISDA SIMM™ 2.4 software module with the ability to seamlessly integrate with your systems via CRIF files or other formats and quickly adapt to regulations changes. We test our calculator implementation against official ISDA unit tests set which is a guarantee of correct model interpretation.

As an ISDA SIMM™ licensed software vendor Everix can help you meet the regulator requirements once your organization becomes eligible to Initial Margin (IM) for uncleared derivatives.

Regulatory Coverage

Initial Margin

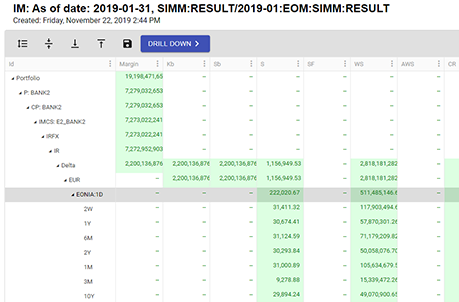

- Full ISDA SIMM™ implementation

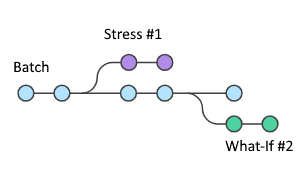

- Fast model updates using Rix Aggregation Engine

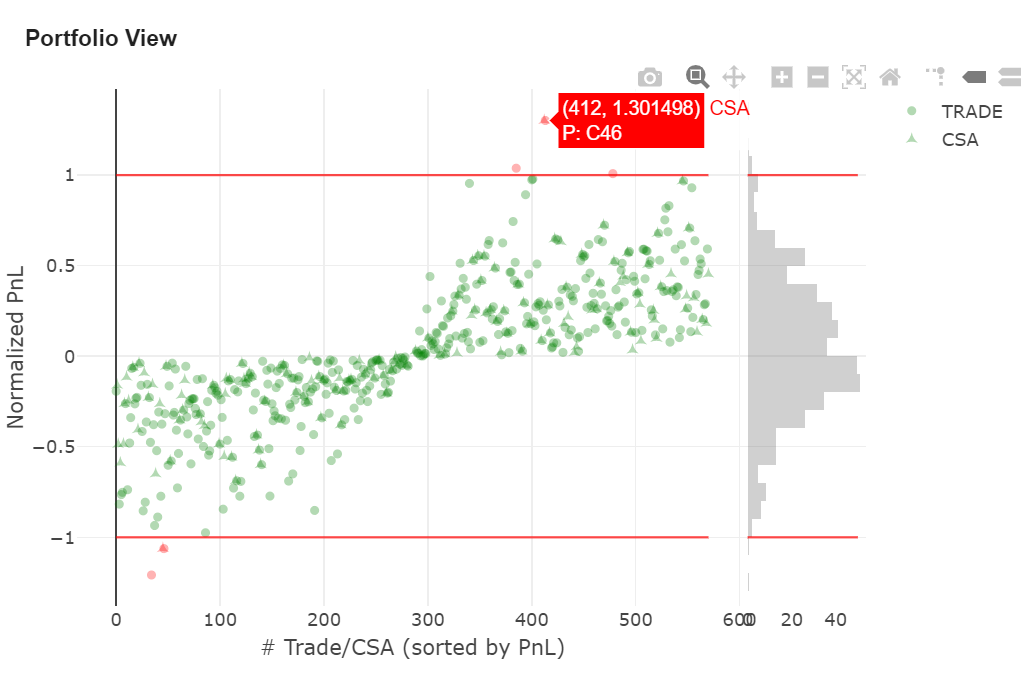

- Automatic backtesting of Initial Margin vs PnL result

- Intermediary metrics visible at various levels

- Drill down up to deal and leg level

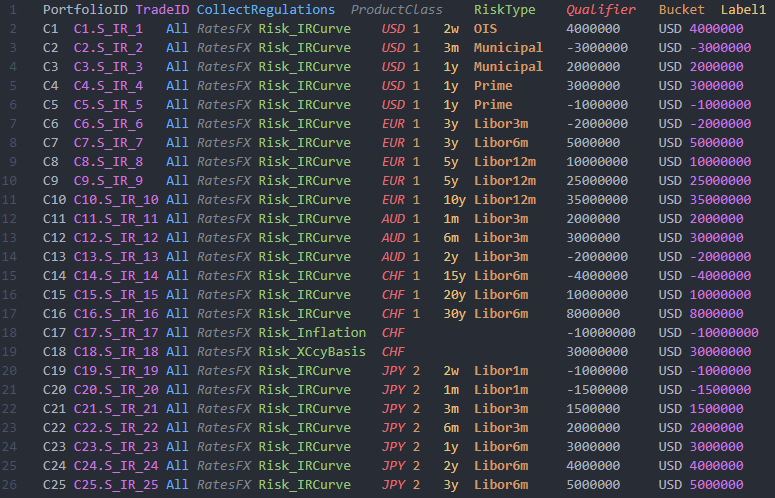

Sensitivities

- Use CRIF files or compute sensitivities directly in Everix

- Easily normalize in-house sensitivities to the SIMM requirements

- Compute IM pledgor and secured for all eligible regulations and takes into account such details as AddOn & schedule method

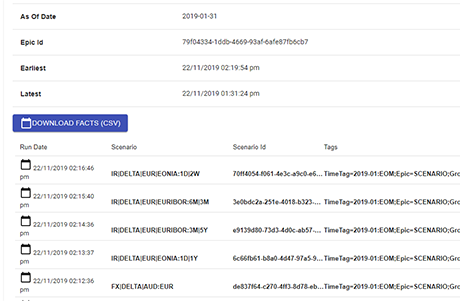

- Adjust and validate your results for auditing

Advanced Features

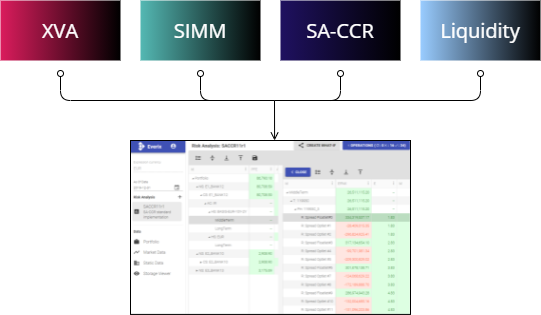

Consolidated view of all charges

- XVA

- IM

- SA-CCR

- Liquidity

Get ready to see it in action!

Get a free demo to know more about our ISDA SIMM™ solution features and see it in action with an actual use case

Where Does it Run?

You can host it at your bank, in your Cloud, in our Cloud or even on a single server.