On Premises or in the Cloud?

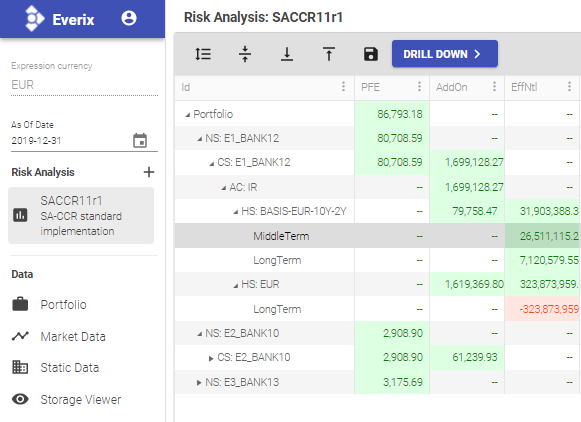

Calculate SA-CCR with marginal and forward metrics

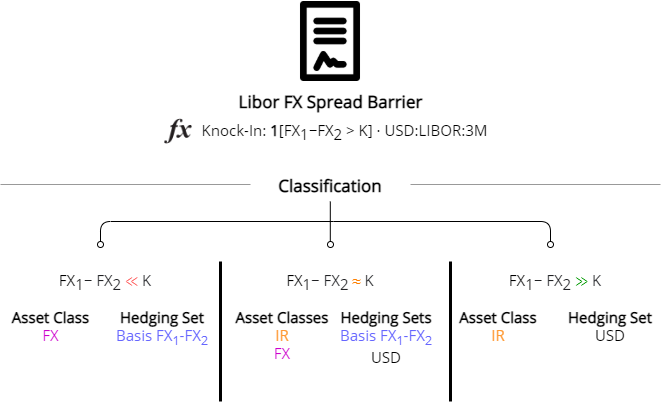

The most advanced SA-CCR calculator implementation addressing main challenges of the regulation: complex pay-offs replication and asset class attribution.

Standardized Approach for Counterparty Credit Risk

Compute your RWA SA-CCR, forecast your capital costs on CSA and reallocated to individual operations. Have a consolidated view with other valuation adjustments and do pre-trade analysis right from your front-office system.

We extensively test our model against BIS framework CRE52 (former BCBS279) following line-by-line the EBA RTS-2019-02 recommendations as part of CRR2.

Robust Implementation

- Full asset classes coverage

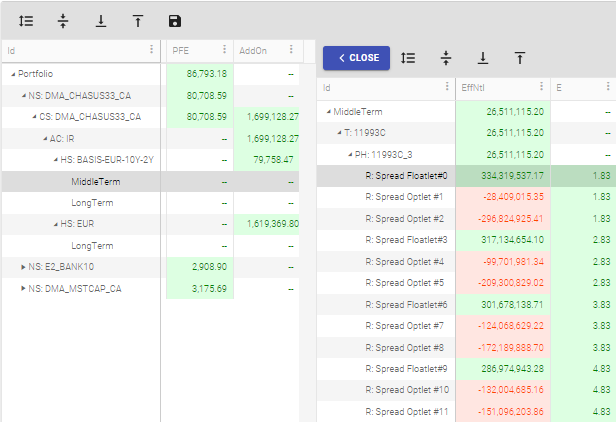

- Drill down up to deal and leg level

- Access to all intermediate metrics

- Fast model updates using Rix Aggregation Engine

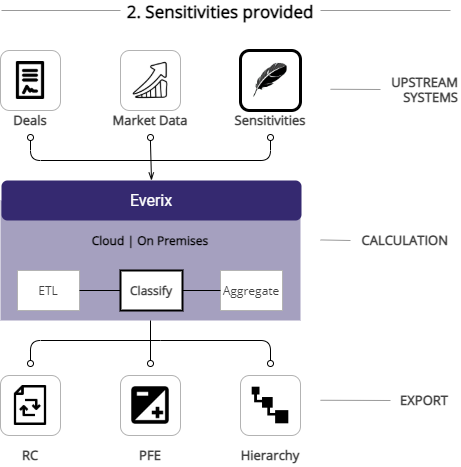

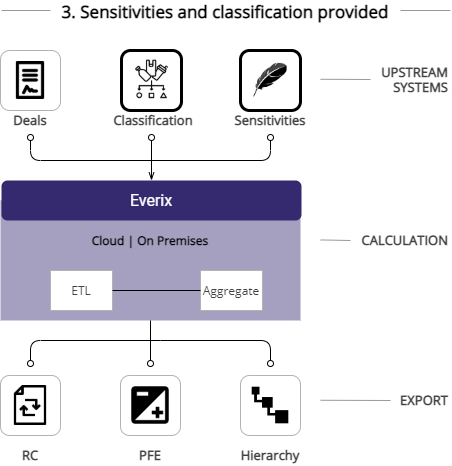

Tailored Integration

- Flexible ETL to connect to your upstream and downstream systems

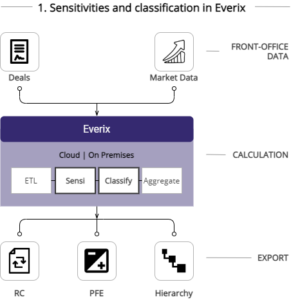

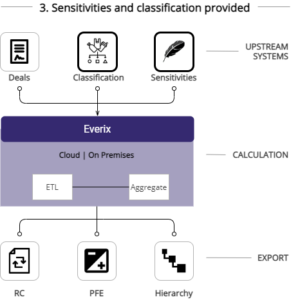

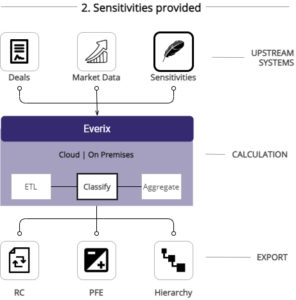

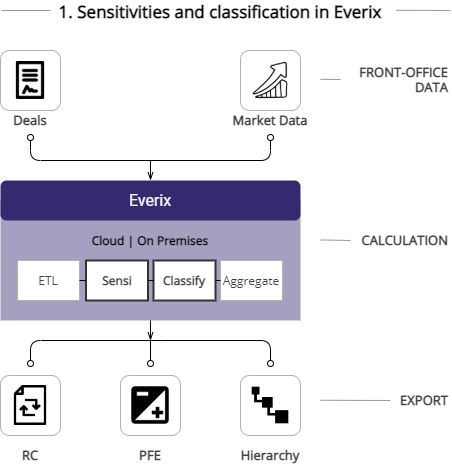

- Integration options: compute all in Everix or provide data

- Use Everix as a platform or as a module extending your existing risk eco-system

Tailored Integration

- Flexible ETL to connect to your upstream and downstream systems

- Integration options: compute all in Everix or provide data

- Use Everix as a platform or as a module extending your existing risk eco-system

Tailored Integration

- Flexible ETL to connect to your upstream and downstream systems

- Integration options: compute all in Everix or provide data

- Use Everix as a platform or as a module extending your existing risk eco-system

Marginal SA-CCR

PFE and RC reallocation per trade

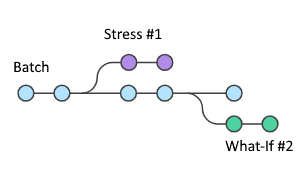

Life-time cost : SA-CCR Forward

Forward calculation based on market data diffusion:

- PFE

- RC

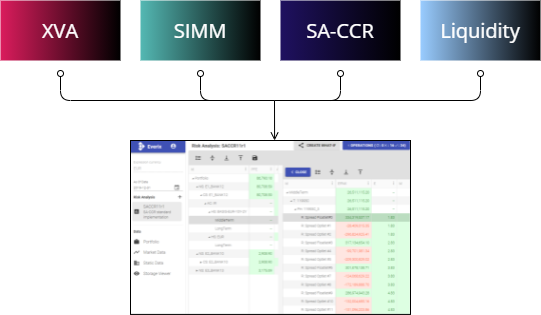

Consolidated view of all charges

- XVA

- IM

- SA-CCR

- Liquidity

Where Does it Run?

You can host it at your bank, in your Cloud, in our Cloud or even on a single server.

Get ready to see it in action!

Describe what you need and we will arrange a demo